What is Swift Code of Bank and How to Find Swift Code For Any Bank

If you’re thinking of sending money to another country, you might want to think of SWIFT codes. These are identification numbers that help ensure that your bank sends your money to the correct place. Understanding what SWIFT codes are and how to find the right one for you is a good idea for anyone who is sending or receiving money internationally.

What is a swift code?

This system helps to identify banks and financial institutions globally. SWIFT code or BIC represents a bank and its location. SWIFT refers to the Society for Worldwide Interbank Financial Telecommunication.

Banks and individuals use SWIFT codes to send messages, move funds between banks, and send funds all over the world, especially sending funds internationally. The electronic transfer of funds from one account to another in a different country is called an international wire transfer.

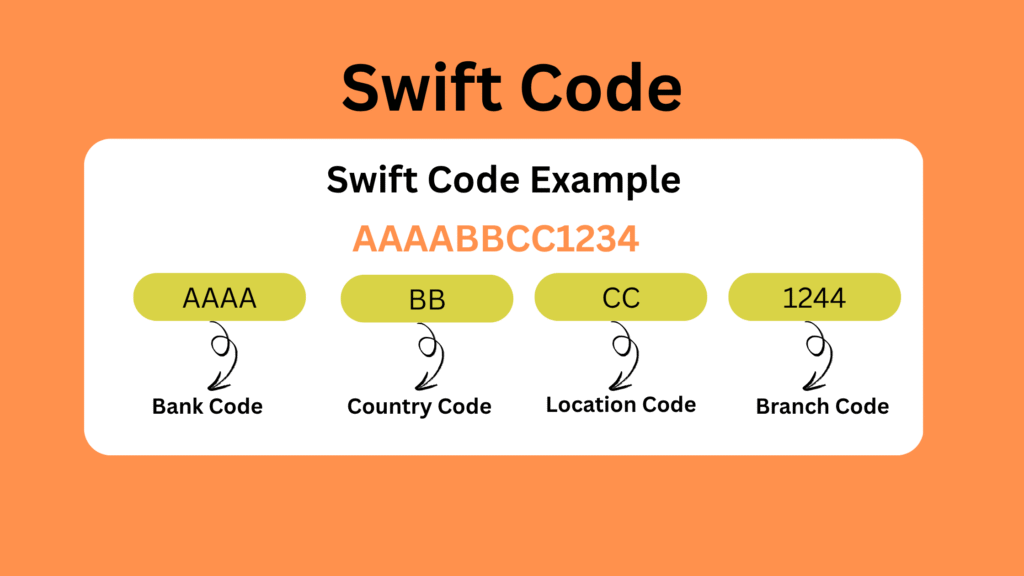

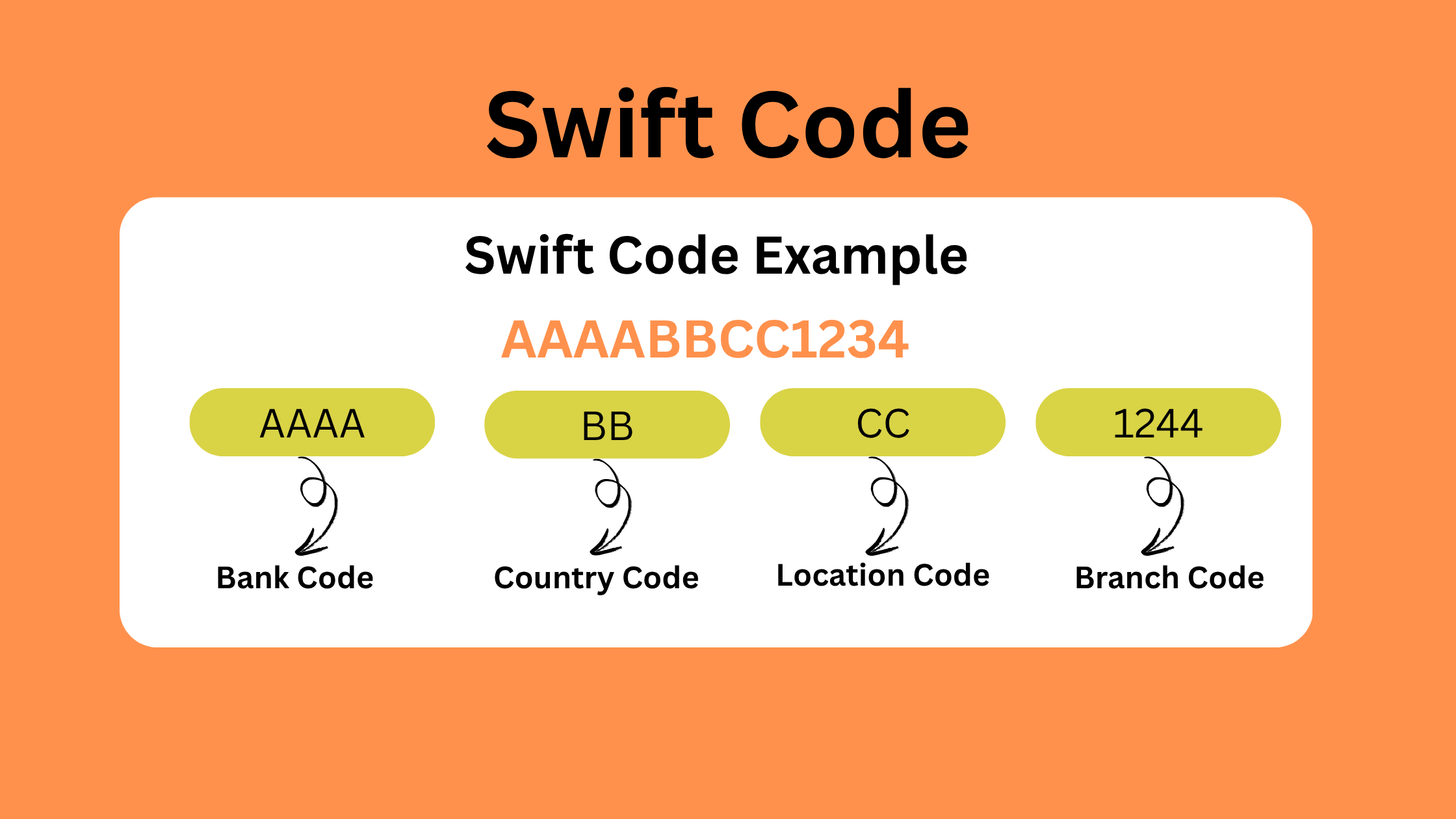

Structure of SWIFT codes

SWIFT code has 8-11 characters which identify the bank or other financial institution, country, and the branch. For example, a swift code is AAAA-BB-CC-123. The elements of a SWIFT code are:

- Country code: Two letters that stand for the country of the bank,

- Location code: The area where the bank is located with two characters, letters, or numbers,

- Branch code: Three letters that stood for the bank branch, or XXX if it is the sale branch.

Get : HDFC Bank Swift Code | SBI Bank Swift Code | ICICI Bank Swift Code

What is the Significance of a SWIFT Code in International Payments?

Below are some of the reasons why SWIFT is used dominantly for International Money Transfer:

- Security: SWIFT uses great means of encrypting and decrypting data to ensure that there is both validity and reliability with money transfers between two entities.

- Ease of Transfer: The SWIFT network makes money transfers overseas both simple and highly secure.

- Compliance: There is a huge amount of complexity that is intertwined with cross-border transactions, including international trade in different countries and SWIFT provides the highest level of compliance.

- Global Network: The SWIFT network offers its global shareholders the ability to take advantage of globalization and get benefits for many countries across the globe.

- Effectiveness: SWIFT ensures that your funds get sent to the right recipient and it is done in a timely and affordable way.

Where to find the SWIFT code?

If you want to do an international transaction and need the SWIFT code you can directly get it in any of the following ways:

- Passbook – Some big banks in India have their swift codes printed on the passbook itself just like in HDFC. You can check the passbook to find the SWIFT code.

- Internet banking page- Some banks have their SWIFT code mentioned on the Internet banking page of their banks.

- Visiting Branch – You can directly visit your home branch and ask for a swift code to get the transaction done.

- Customer care – If you are not able to find the swift code in any of the two ways the last possible way is to contact the customer service of your bank and ask them for the swift code by giving all the necessary details.

Conclusion

SWIFT codes are essential identification codes that allow for safe, reliable, and effective international money transfers. Anyone involved in sending or receiving money across international borders must understand SWIFT codes and their significance. These special codes, commonly referred to as Bank Identifier Codes or BICs, help prevent mistakes and make cross-border payments more secure, helping to make sure that your funds arrive at the correct financial institution and branch. By taking advantage of the SWIFT network’s global reach, individuals can thoughtfully manage complex issues of international payment and collections. Many options are available to locate the necessary SWIFT code, including bank passbooks, internet banking pages, visiting a branch, and speaking with customer care.

Read Also: What is the Difference Between SWIFT Code and IFSC Code?

FAQs

1) Define a SWIFT code. Why is a SWIFT code important for international transactions?

Each bank or financial institution has a particular SWIFT code, or BIC (Bank Identifier Code), that distinguishes an organization all around the world. SWIFT codes are important for international transactions because they help to ensure your funds go to the right bank and the right branch in another country, improving security, ease of transfer, and compliance when sending payments internationally.

2) What does SWIFT stand for?

The Society for Worldwide Interbank Financial Telecommunication is commonly known as SWIFT.

3) What does a SWIFT Code mean?

A SWIFT code has 8 – 11 characters which denotes the bank, country, location, and branch. For example, in AAAA-BB-CC-123:

- The bank code is AAAA

- The country code is BB

- The location code is CC

- The branch code is 123

4) How does SWIFT ensure the security of international money transfers?

SWIFT ensures the security of data transferred between entities during money transfers by applying advanced encryption and decryption procedures for the purpose of securing the network. This high-level security architecture affords a safe network for international payments through trust and reliability guarantees of the transaction.

5) Where can I find my bank’s SWIFT code?

There are generally a few different ways to find your bank’s SWIFT code:

- Passbook: The SWIFT code of some banks is printed on the passbook.

- Internet Banking Page: A lot of banks show their SWIFT code on their online banking page.

- Visit Branch: Go to the branch of your nearby bank to get the SWIFT code.

- Customer Service: Another reliable option to find the SWIFT code is to call the customer service of your bank.

Read also : What is a CIF Number?

Share this content:

Post Comment