What is the Difference Between SWIFT Code and IFSC Code?

As the banking sector continues to undergo transformations, many measures have been introduced to ensure the safety and security of individuals, such as SWIFT codes and IFSC codes to secure transactions. However, today’s world showcases various fast international and domestic transactions where you can use these codes for secure transfers. These SWIFT codes and IFSC codes are useful for ensuring a safe transaction process.

What is SWIFT Code?

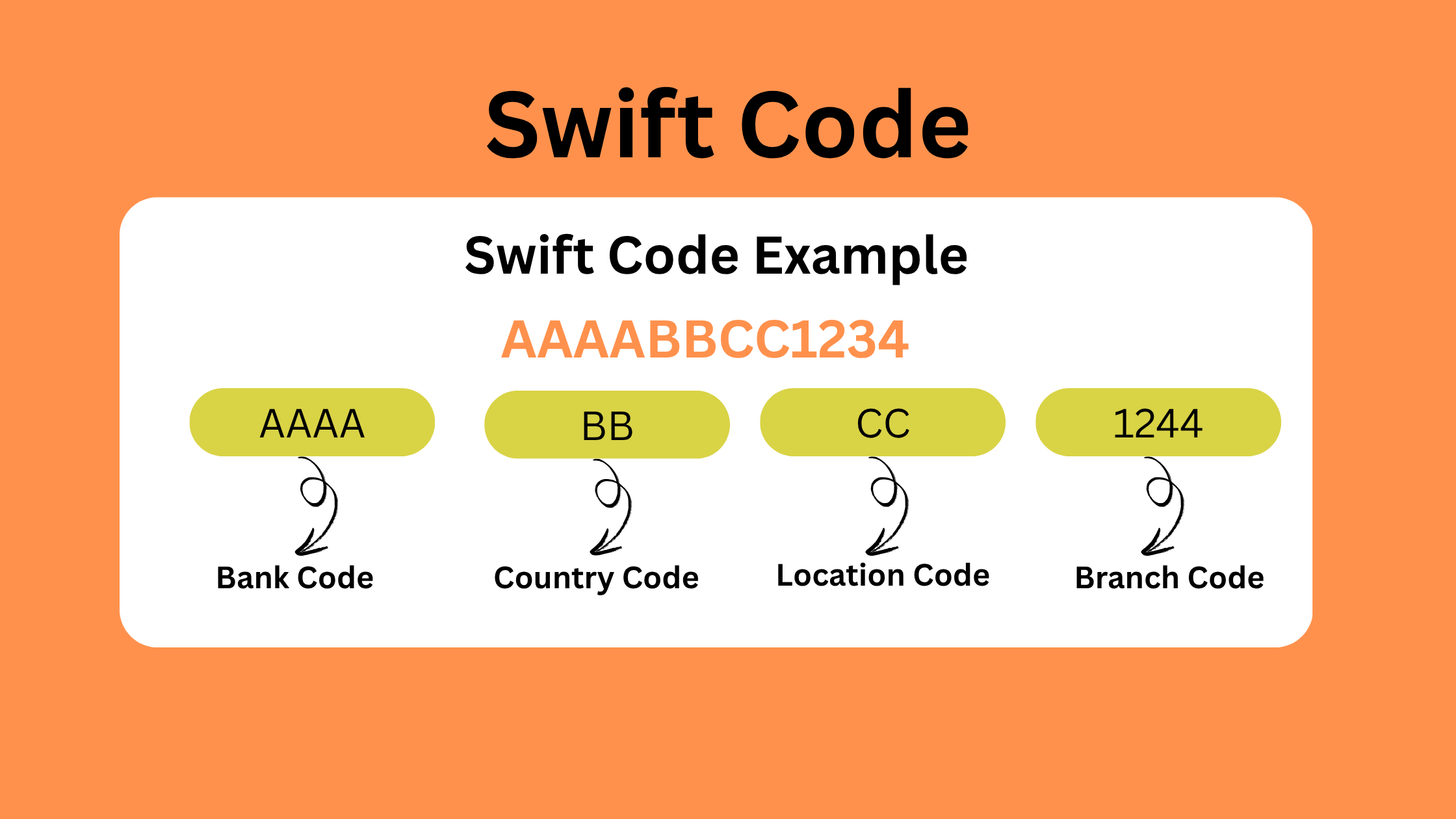

International banking plays a huge role in both personal and business transactions whether for sending money or receiving money internationally, and for this purpose you often encounter the term SWIFT code. The SWIFT code is also known as the BIC code (Bank Identifier Code) which serves as a unique identifier for tracking international payments. The SWIFT code consists of 8 to 11 characters where the first 4 digits are considered bank codes which are used to identify the bank, the next two characters are the country codes which show the identification of the country, and the other 2 digits tell about the location code and the last three characters are optional which is head as a branch code used for identifying a specific branch.

Importance of SWIFT Code in the International Banking System

The SWIFT code plays a crucial role in international transactions and helps banks to communicate for secure transactions across countries. Here we have shared some of the key benefits of SWIFT code:

- Security- The SWIFT codes are useful for providing secure transactions and also play an important role in protecting against fraud.

- Global recognition- SWIFT codes are used for international transactions and that’s why these codes are considered globally recognized codes which allow different banks to transfer funds easily across the countries.

- Intermediary banks- The international transaction needs intermediary banks and in this, the SWIFT code plays a useful role in delivering the message correctly and ensuring the reaching of the funds to its final destination.

- Efficiency- These SWIFT codes provide a faster and more reliable international transaction between the banks.

How to Find the SWIFT Code?

you need to follow some basic steps to find your bank SWIFT number which is given below:

- Through the bank website- If you want to find your bank SWIFT code you have to first check the national or wire transfer section or their website.

- Bank statements- The bank statements are also used for finding your bank SWIFT number which is printed on your monthly statement.

- Customer services- You can directly contact your banks for your bank SWIFT number.

- SWIFT directory- To find your SWIFT number well you also use trusted online directories such as the official websites to search your code.

What is the IFSC Code?

The IFSC code, or Indian Financial System Code is the 11-character alphanumeric code which is exclusively for Indian bank branches. This code is essentially for the banks involved in electronic fund transfers. This code helps ensure the security of customer transactions during these operations. These codes are assigned by the Reserve Bank of India and also serve as crucial identifiers in electronic fund transaction systems such as NEFT, RTGS, and IMPS. However, the Indian banking system underwent various transformations since its establishment and after the establishment of the Reserve Bank of India in the year 2008 the IFSC code was designed for better and streamlined transactions of the funds. As the technology increases the IFSC code becomes an important part of the NEFT, RTGS, and IMPS. Moreover, the IFSC code also plays a huge role in the Unified Payment Interface and other digital payment transactions for secure and easy payments.

Importance of the IFSC Code in the Banking System

The IFSC code has various importance and significance in the banking sector which is given below:

- Electronic transaction- The IFSC code is important for transactions Involving NEFT, RTGS, and IMPS. The electronic transaction or fund transfer process relies on IFSC code which ensures the secure transaction of funds of its customers.

- Online banking- As the digital banking system expands the online banking big Mama part of day-to-day affairs. The IFSC code became an integral component of the online banking which is used to initiate the fund transfers and other online transactions such as paying the bills, emi’s insurance premiums and many more.

- Accurate transfers- The IFSC code stands for International Financial System Code and plays an important role in ensuring the safety and security of the funds. It carries a unique alphanumeric combination which ensures the correct destination of transferring the funds.

- UPI transactions- UPI stands for the unified payment interface which gained a lot of popularity for its speedy transaction. IFSC code plays an important role when transferring funds through the UPI between different banks. You can also use your mobile number or payment address and the IFSC code for successful transaction of the funds.

How to Find Your Bank’s IFSC Code?

To find your bank IFSC code you have to follow some of the basic steps which are given below:

- Bank account passbook- If you want to find your bank’s IFSC code it can be done through your passbook. You can check your passbook sheet fall branch details including the IFSC code which is printed on the corner of the sheets.

- Cheque book- The IFSC code is usually located at the top of your cheque book.

- RBI website- To locate your IFSC code, simply visit the RBI website and enter the name of your bank’s branch..

Difference Between IFSC Code and SWIFT Code

| IFSC CODE | SWIFT CODE |

| the IFSC code stands for the Indian Financial System Code which is a unique alphanumeric code used for the identification of the branch within a country | the SWIFT code is used for international transactions and it carries a systematic code that is used to identify the international financial institutions |

| The IFSC code is usually used only for domestic transactions and it is important for interbank transactions within India. | The SWIFT code plays a crucial role in international money transfers, serving as a key communication tool between financial institutions worldwide. |

| The IFSC code carries an 11-digit alphanumeric code which consists of different numbers and letters | Whereas the SWIFT code carries eight to 10 characters which also consists of different numbers and letters. |

| The IFSC code transfers the funds within a country which also includes the RTGS next add Imps services etc | The SWIFT code ensures safer transactions at the international level and it also includes foreign currency transfers and international remittances. |

| The IFSC code is typically utilized for domestic transactions, including bill payments and electronic fund transfers within India’s banking framework. | However SWIFT code is an essential requirement that is used for international trade and transactions in different currencies. |

FAQs

1) Are SWIFT code and IFSC code the same?

The SWIFT code and IFSC code serve different purposes. The SWIFT code is used for international transactions, whereas the IFSC code is designed specifically for transferring funds within the country.

2) How can you find a Bank’s SWIFT code?

To find your bank’s SWIFT code, just check your documents or the bank statements linked to your account. Apart from that you also check your account details from any online banking profile.

3) Does India have SWIFT code?

Absolutely, each bank in India is assigned a distinct SWIFT code.

4) Is MICR the same as a SWIFT code?

No, they both are different, the swift code is the identification code that is used for international transactions whereas MICR is our number series which is used at the bottom of the check which is helpful in verifying the checks.

5) How can you find your bank’s IFSC code?

You can locate your IFSC code by referring to your bank documents, including items like your checkbook and passbook.

Recommended:-

| 1. | How to Find Ifsc Code for ICICI Bank Using Account Number? |

| 2. | How to Find IFSC Code |

| 3. | Airtel Payments Bank IFSC Code |

| 4. | How To Check IfSC Code In Kotak App |

| 5. | How to check the IFSC code in the Yono App |

Share this content:

Post Comment