What is an IFSC Code & How to Find IFSC Code

Banks in India have various branches all over the nation. To identify each bank and its branch separately, RBI provides the IFSC code. You might have used the IFSC code somewhere or the other, especially during E-transactions. People usually don’t know the IFSC code of their bank. However, if you take a closer look, you can find it printed on your passbook or other bank documents. You can also find the IFSC code online easily. Here, we will give you the complete details about the IFSC code and how to find it.

What is IFSC Code?

The Indian Financial System Code (IFSC) is an unique 11-character identifier that incorporates a combination of both alphabet and numbers. This distinctive identification number is provided by the Reserve Bank of India which serves as the bank’s identity and its branches. The first four digits of the IFSC code represents the identity of the bank, while the last six digits indicate the branch of the bank. The IFSC code is one of the essential digital payment systems which offer various hassle-free services to its customers.

Example of IFSC Code

To illustrate this point, the IFSC Code of the Langford Branch of ICICI Bank is ICIC0000269, where the first 4 characters define the bank’s name, 0 remains the same in each code and the last 5 characters identify the specific branch name.

Sample IFSC Codes of top banks in India

Here we have provided a sample of some of the renowned banks and their IFSC codes:

| Bank name | Sample IFSC Code |

| Canara Bank | CNR0000791 |

| ICICI | ICIC0000047 |

| SBI | SBIN0005943 |

| Bank of India | BKID0008426 |

| HDFC | HDFC0000009 |

| Union Bank of India | UBIN0530786 |

| Kotak Bank | KKBK0000172 |

| AXIS Bank | UTIB0000009 |

How to Find IFSC Code?

If you are searching the answer for “how to find ifsc code?” Here we have outlined four ways to find the IFSC code of a bank branch:

1) Bank Account Passbook

The passbook of the bank contains all essential information about the bank and its branches, including the IFSC code.

2) IFSC Code in Cheque leaf

The passbook contains the cheque leaves, which includes the IFSC code and the branch name is located in the upper left corner of the cheque.

3) Check locator tool

You can access the branch locator tool offered by most banks on their official website. Here, just by entering the branch, bank, and state details, you can find the IFSC Code of any branch

4) RBI Website

The RBI website gives quick and easy access to get the IFSC code as you can find the section of ‘IFSC’ on the homepage, where you can search for your IFSC by entering the branch or bank name.

Tip: It is vital to pay close attention and input an accurate code performing online transfer. As an incorrect code might lead to fund misdirection or delayed funds.

Why is the IFSC Code Important?

Here we will be talking about the importance of IFSC:

1) Enables paperless transaction

IFSC is ideal for paperless money transactions which helps in making online transactions through various money tools like NEFT, IMPS, or RTGS. These tools aid in the quick transfer of funds between different bank branches on the same day. The best part is that it doesn’t require any physical presence of the beneficiary in the bank, making it a hassle-free process. Thus, this digital money-transferring method is quick and eco-friendly.

3) Precise fund routing

IFSC helps provide quick information regarding the branch and bank where the account’s beneficiary is situated. Besides, it ensures that the money exchange process is directed to the correct branch, resulting in accurate and timely payments.

4) Promotes transparency

Through IFSC, RBI can direct all electronic exchanges and monitor potential dangers. In addition, it promotes transparency and guarantees accountability towards consumers.

5) Supports different services

Through IFSC, buyers can encourage numerous online services such as paying insurance premiums, paying bills, taxes, paying off loans, etc. IFSC guarantees the simple conduct of e-commerce purchases and sending cash from one person to another. Thus, it provides smooth access to your bank account and leads to carefree banking experience.

Things to remember while searching for IFSC

Here are some of the points that one should keep in mind while searching for IFSC:

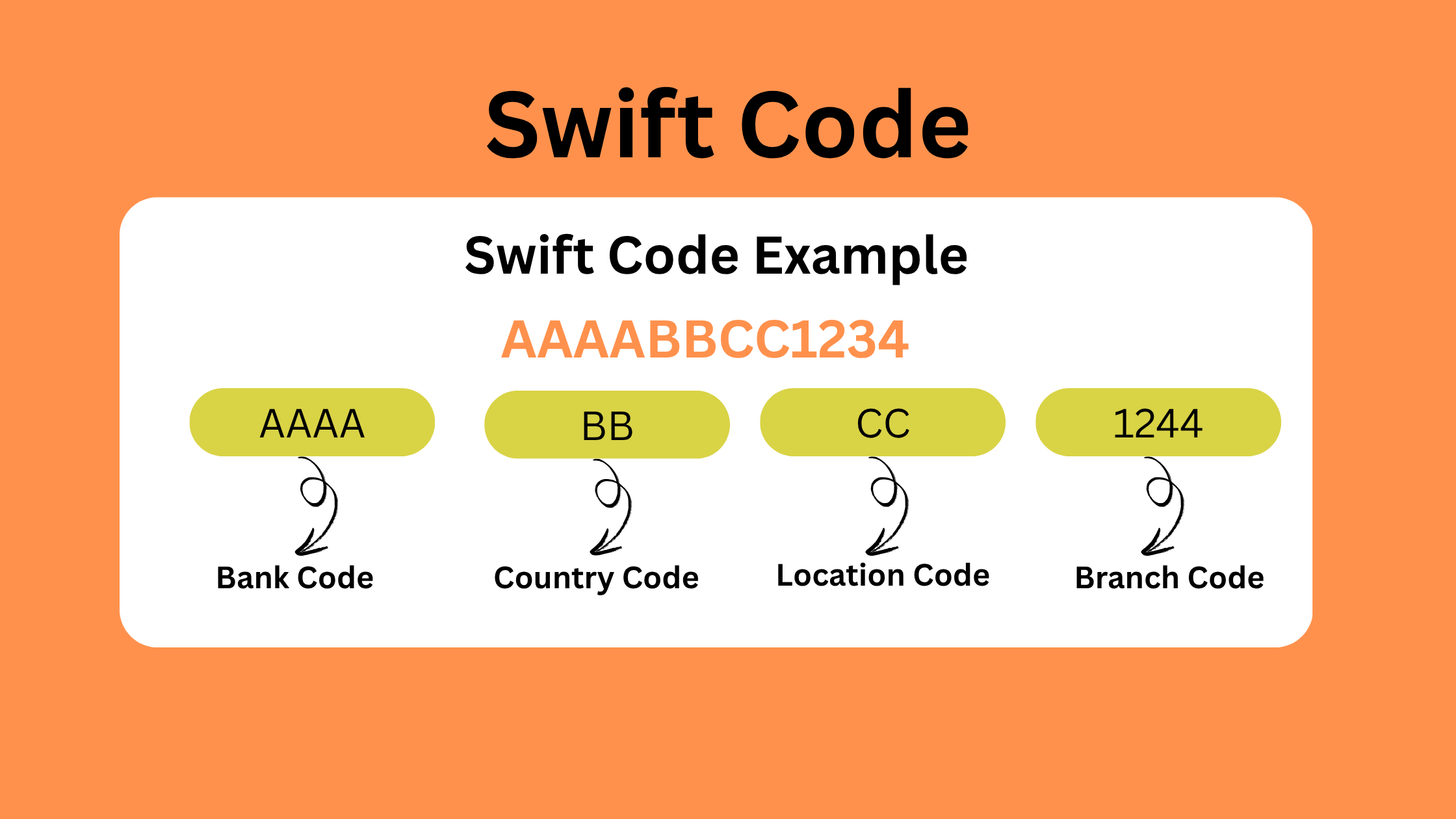

- SWIFT and IFSC codes are similar codes but are considered to be distinct due to their usage in online fund transfers, as IFSC is used for domestic transfer and SWIFT is used for international transfers.

- You cannot derive the IFSC code from an account number even if your account number remains unchanged, the IFSC may change if you shift to another branch.

- IFSC is an 11-character alphanumeric code which is used for identifying the branch and bank of the beneficiary. While SWIFT Codes are 8 or 11-character codes used for identifying the bank or branches internationally.

How does the IFSC Code work?

Below we have provided a quick step-by-step process for utilizing the IFSC code:

- Step 1: Firstly, locate the 11-digit alphanumeric code which is different for each bank’s branch. The recipient can find this code on the cheque receipt, passbook, or bank’s official website.

- Step 2: While starting an online transaction through electronic exchange tools, you are required to fill in your account number along with the IFSC Code to complete the transaction.

- Step 3: Following the transaction confirmation, the bank will transfer the funds to the beneficiary’s account.

- Step 4: The online exchange is monitored by the Reserve Bank of India through a National Clearing system, ensuring that the reserves reach the correct account.

Features of IFSC Codes

Here are the features of IFSC Codes:

- Regulated by RBI:- Through IFSC Codes, RBI ensures that the banking exchanges are done securely and accurately. IFSC Codes help reduce the chances of blunder in fund transfers as the system contains all the details of the transaction sender and receiver.

- Fraud prevention:- IFSC also helps in ensuring secure fund transfers and helps prevent unauthorized transactions.

- Quick fund transfer:- IFSC helps in facilitating same-day or real-time digital transfers.

FAQs

1) Can the Ifsc Code Be Found Through the Account Number?

No, it is not conceivable to find the IFSC Code through the account number, you are required to have your branch details to discover the IFSC.

2) Is the Ifsc Code Similar to Swift Code?

No, IFSC Code and SWIFT Code are two diverse codes, IFSC Code is utilized for domestic transactions while SWIFT Code helps in making global transactions.

3) Is the Ifsc Code Important?

Yes, the IFSC code is very crucial as it helps in making online transactions in India.

4) Can We Share Our Account Number and Details with Others?

Account number and IFSC Code are an individual’s personal details and should not be shared with others under any circumstances because it can lead to scams, theft, etc.

5) How Do You Check Bank Details Online?

The bank details can be checked by going to the official site of the bank and entering your account number.

Recommended:

| 1. | Airtel Payments Bank IFSC Code |

| 2. | How To Check IfSC Code In Kotak App |

| 3. | How to check the IFSC code in the Yono App |

Share this content:

Post Comment