How To Check IFSC Code In Kotak App

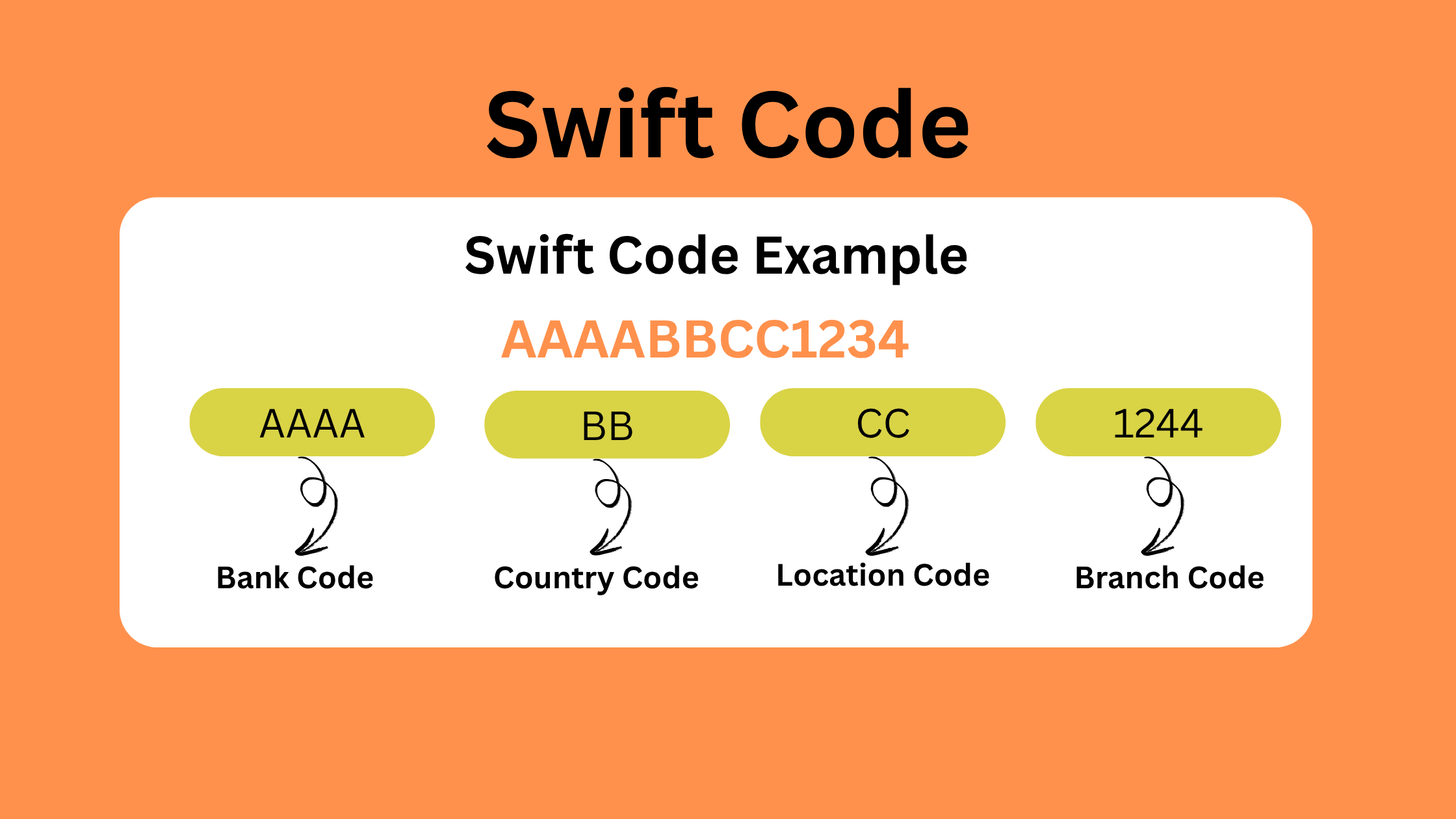

Kotak Mahindra Bank is one of the oldest banks whose headquarters is in Mumbai. Kotak Mahindra Bank provides a wide range of banking solutions tailored for both corporate and retail clients, including investments, life insurance, wealth management, personal finance, and much more. The Kotak Mahindra Bank was established in 1985 and in 2003, it became one of the popular non-banking finance companies under Uday Kotak who is the executive director of the Kotak Mahindra Bank. However, the IFSC code stands for the Indian Financial System Code which is of 11 Alphanumeric codes divided into 3 components in which the first 4 characters represent the bank names and the last 6 characters represent the branch. The fifth one always represents the 0 which is reserved for future use. The Kotak Mahindra Bank provides three specific ways to remit money which include NEFT, RTGS, and IMPS, and for these transactions. We need to obtain the Indian financial service code that has been issued by the Reserve Bank of India. Moreover, each bank and its specific branch has its own IFSC code, which ensures safe and secure transactions within a country.

Role of Kotak Mahindra Bank’s IFSC Code in Fund Transfers

As we all know, Kotak Mahindra Bank is one of the most popular Banks in the country and its headquarters are located in Mumbai also, it is considered the nation’s fourth largest Indian private sector bank, which was founded in 1985. Kotak Mahindra Bank boasts an extensive network with over 1,600 branches and more than 2,519 ATMs across India. Kotak Mahindra Bank provides various banking services to its customers such as loans, insurance services, corporate banking, fixed-income securities, and many more and it supports various electronic fund transfer modes such as NEFT and RTGS which are offered across the country by using the IFSC code.

How to use Kotak bank IFSC code for NEFT services?

You can utilize the IFSC code when the recipient’s bank branch is mapped or enabled for RTGS. Customers of Kotak Mahindra Bank have the convenience of transferring funds effortlessly to anyone with an account at any bank.

NEFT stands for the National Electronic Fund Transfer. It is an online electronic payment platform launched by the Reserve Bank of India. It is one of the most popular used electronic fund transfers in the country which helps individuals and businesses transfer funds securely and seamlessly from one bank to another. This NEFT system is regulated and managed by the Reserve Bank of India, which ensures an efficient means of transferring funds within the country.

Advantages and disadvantages of NEFT

Here we have discussed Advantages and disadvantages of NEFT:

advantages of NEFT payment

- The National Electronic Fund Transfer provides a very convenient way to transfer money electronically within our country from the comfort of houses and offices.

- With the help of NEFT, you will be able to transfer your funds electronically 24×7.

- NEFT transactions are typically straightforward and economical when compared to other options.

Disadvantages of NEFT payments

- The NEFT electronic fund transfer is very useful, but it is not instantaneous as it is processed in batches, which may lead to delays in money transfer.

- To send money using NEFT, both the sender and the recipient must have accounts that support NEFT transactions.

- NEFT doesn’t provide any immediate confirmation of the transaction like IMPS and UPI services.

Where to find Kotak Bank IFSC code?

IFSC code acts like a unique address which serves as an important factor for transferring funds from one bank to another bank. The correct use of the IFSC code can ensure a hassle-free and seamless transaction of funds. Also, the IFSC code helps the Reserve Bank of India track all the necessary transaction details throughout the country.

You can find the IFSC code of Kotak Mahindra Bank by following these steps:

- Visit the RBI website: You can check your IFSC code by selecting your bank and branch name from the drop-down menu on the RBI’s official website.

- Online banking platform of Kotak Bank: The mobile banking facility or online banking services are also used for finding the IFSC and MICR codes for your specific bank branches.

How to check ifsc code in kotak app?

Follow some of the basic steps to find your IFSC code in Kotak Bank:

- In the first step, open the Kotak banking application on your device. If you don’t have it, you can download it to your Play Store.

- In the next step, log in to your account using your bank details and if you don’t have an account, you might need to set up one first.

- After logging in, explore the features and services.

- Click on “Branch Locator” or “Find IFSC Code.” Here, you can easily find the IFSC code for your specific bank branch.

- Enter your details like city or branch name.

- After entering all the necessary details, the Kotak application will display your branch details including the IFSC code.

Conclusion

If you are looking for “how to check ifsc code in kotak app”, you can get the solution here. You simply have to download the app and then locate your bank and branch to see the IFSC code. The app is developed by the Kotal bank for the ease of customers. You can find your IFSC code easily and conduct various banking activities from your mobile phone.

FAQs

- How do I check my Kotak IFSC code?

IFSC code can be checked through net banking or the mobile app by clicking on the overview section.

- How do I see my bank branch?

Bank branch details are written on bank statements or passbooks, which can be checked online or offline. You can also log in to your Net banking account or find it by IFSC code.

- What is the IFSC Code of Kotak credit card?

The IFSC Code of Kotak credit card is KKBK0000958, this code is available in all your banking documents as it helps in making transactions.

- How can I know my Kotak bank details?

Bank details can also be viewed in the bottom corner of the checkbook book as account numbers are also written there. Additionally, account details are also available in the account summary.

- Where is the IFSC Code on the card?

IFSC Code is provided along with the account details when the card is issued. You can also visit the official website or the nearest bank branch to find it.

Disclaimer: This article is for information purpose only, We are not associated with Kotak Bank in any manner,

Share this content:

Post Comment