Airtel Payments Bank IFSC Code and MICR Code

As technology advances various transformations are also taking place in the banking sector such as IFSC (Indian Financial System Code) and MICR (Magnetic Link Character Recognition). Airtel Payments Bank is one of the most powerful banks in the country that offers various innovative and exciting services to its customers. This bank became famous because it provides effortless and convenient services and the headquarters of the Airtel payments bank is in New Delhi.

This bank was introduced by Bharti Airtel in the year 2017 which is considered as the biggest telecom network provider that offers a seamless cashless revolution introduced by the Government of India. Also, the Airtel payments bank provides various services to its customers such as opening a Savings Bank account, accident insurance, providing online debit cards, depositing cash at nearby banking points, cash withdrawal, and many more. The Airtel payments bank promised its customers to make their payments hassle-free cashless and seamless.

Airtel Payments Bank Revolutionizing Digital Banking

Airtel Payments Bank is one of the leading and well-known banking platforms which provides various effective services to its customers such as saving accounts, fixed deposit, transfers payments and many more. With the increase in technology, we have witnessed hassle-free banking services by the Airtel payment bank to its customers.

How to find Airtel Payment Bank IFSC Code and MICR code?

You can find the airtel payment bank ifsc code and MICR code by following these steps:

- Airtel Payments Bank Websites- If you want to find your IFSC code then you must visit the official website of Airtel Payment Bank to find your code.

- Bank account statements – You can also use your bank account statement to find the IFSC code or MICR code of your Airtel payment bank branch.

- Mobile banking application – You can also access your IFSC code and MICR code of the Airtel payment bank mobile banking application.

Airtel Payment Bank Services

Airtel payment bank provides a wide range of services to its customers such as

- Saving accounts

- Bill payments and recharge

- Insurances and loans

- Fund transfers

- Fixed deposits

What is the IFSC Code?

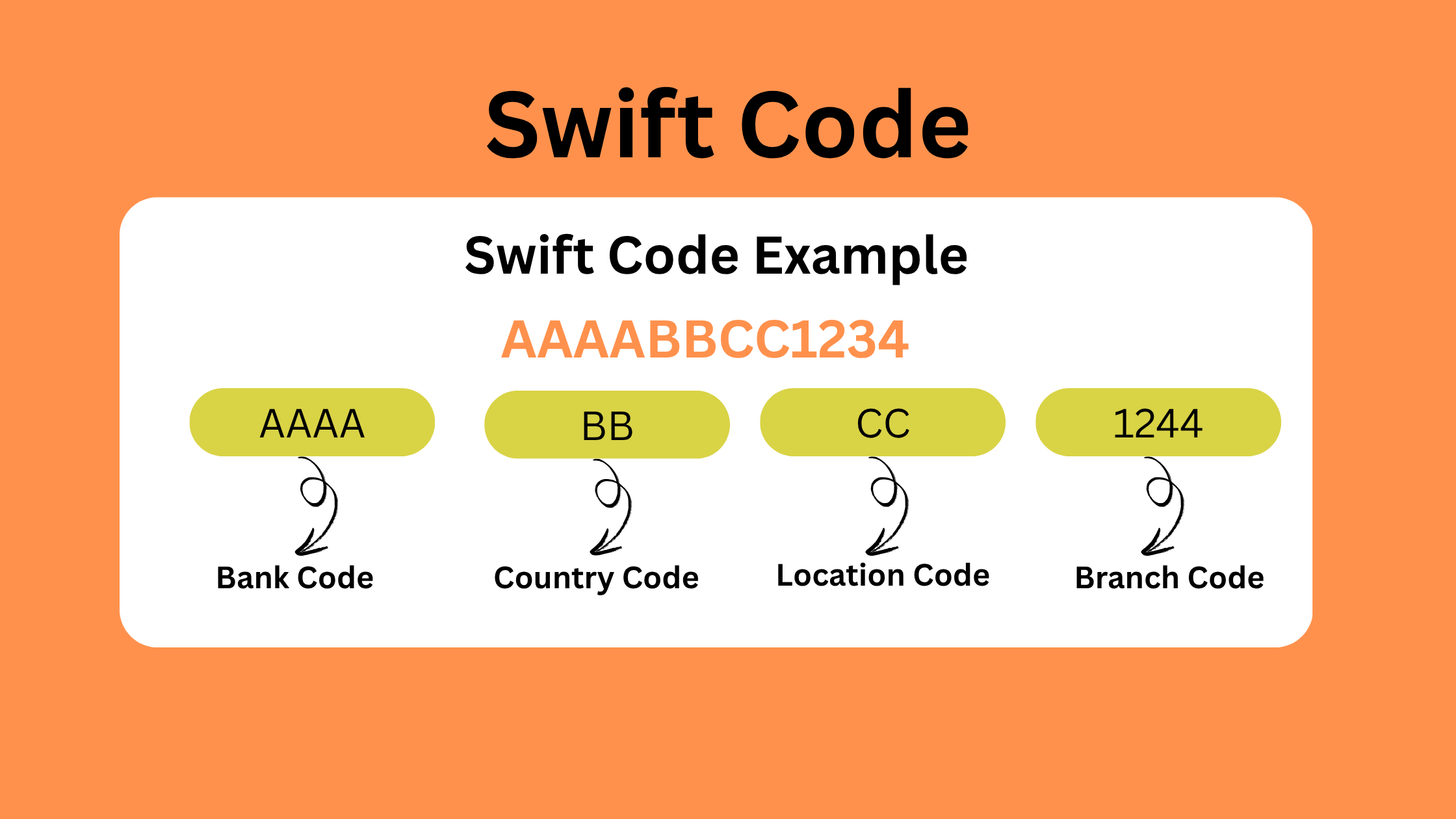

IFSC code is the unique alphanumeric combination of 11 characters which is used as the identifier for a particular bank branch within a country’s financial system. Every bank uses electronic fund transfers and for this transfer, they need the unique IFSC code for smooth and trouble-free transactions. Similarly, airtel payment bank ifsc code is also used for e-transactions. The IFSC code serves as one of the important identifiers in electronic transactions such as NEFT (national electronic fund transfer), RTGS (real-time gross settlement), and IMPS (immediate payment services). The Indian financial system code ensures that the funds are transferred to their correct locations. Also each part of the IFSC code carries certain important information in itself.

What is the MICR code?

The MICR code stands for magnetic ink character recognition which is used to spot magnetic ink characters on cheques. The MICR code consists of 9-digit numbers which are in the center of every cheque leaf which helps ensure the transaction authenticity. However, every bank has its own MICR code which you can find on every page of your cheque book which is issued by the banks. Apart from that you are also able to find a branch’s MICR code on the official website of the banks. The MICR codes are issued by the Reserve Bank of India to ensure the safety and efficiency of the individual while processing check payments. Moreover, every bank branch is assigned a different MICR code which is of 9-digit numbers in a particular format and these numbers are divided into 3 parts: city codes, bank codes, and branch codes.

FAQs

1) Can the IFSC code be used for international transactions?

No, the IFSC code is only for domestic electronic fund transfers within a country.

2) Do Airtel payment banks have different MICR codes?

Yes, every branch has its unique MICR code.

3) What can we do if we enter the wrong IFSC or MICR code during a transaction?

If any individual enters the wrong IFSC and MICR code it can result in transaction failure or delays.

4) Does the Airtel payment bank charge for using IFSC and MICR codes for transactions?

No, Airtel Payments bank does not charge for using IFSC and MICR codes in transactions.

5) How to contact Airtel Payments Bank customer care?

The customer can dial the customer care number of Airtel i.e. 1800-23400.

Read More:

Share this content:

Post Comment